The US dollar is enjoying its longest winning streak in nearly nine years.

The greenback was heading for its eighth-straight week of gains against a basket of other major currencies on Friday, its best run since winter 2014-2015. It has gained 5% since mid-July.

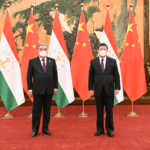

The rally comes after months of volatility, fueled by concerns that the dollar may be losing its status as the world’s reserve currency. Speculation about the potential de-dollarization of global trade rose again last month after the Chinese-led expansion of the BRICS group of nations to include major oil producers, such as Saudi Arabia.

“Rumors of the US dollar’s demise continue to be greatly exaggerated,” James Athey, investment director at Abrdn, an asset manager, told CNN.

The US Dollar Index, which now stands at its highest level in six months, has been buoyed by a slew of positive economic data from the United States in recent weeks — fueling expectations that the Federal Reserve will keep interest rates higher for longer. Higher interest rates tend to boost the value of a country’s currency by attracting more foreign capital, as investors anticipate making bigger returns.

Meanwhile, storm clouds have gathered over the economies of China and Europe.

“The US economy continues to demonstrate remarkable strength, while matters in China and Europe, in particular, seem to be descending into a much more recessionary place,” Athey added.

Resilient US economy

US unemployment is hovering near its lowest level in 50 years. Hiring remains solid, having notched its 32nd consecutive month of growth in August. And wages, when adjusted for inflation, are rising.

Many economists have revised their growth forecasts higher in response to all the good news. A so-called “soft landing” — that is, when a central bank successfully lowers inflation without tipping the economy into recession — now looks increasingly likely.

“The US economy continues to surprise to the upside,” Carsten Brzeski, global head of macroeconomic research at ING, told CNN. “[It] seems to be more resilient than feared.”

That should give American consumers the confidence to carry on spending — and the US Federal Reserve greater incentive to keep interest rates stuck at a 22-year high in an attempt to cool inflation.

The Fed has “less of a reason to cut rates aggressively next year,” Brzeski said, adding that a comparatively weak economic performance by Europe leaves “very little room for the [European Central Bank] to continue hiking” its main lending rate.

Russ Mould, investment director at AJ Bell, told CNN that the difference between the two interest rates — “and the prospect that it may remain and not shrink” — was a “big factor in the dollar’s renaissance.”

Weak economies elsewhere

Europe and China are in a tricky economic spot.

The euro has lost 4.4% of its value to trade at $1.07 since mid-July. The Chinese yuan has slumped by 2.6% in that time to hit its lowest level against the dollar in 16 years.

While the US could clinch a “soft landing,” Athanasios Vamvakidis, head of G10 FX Strategy at Bank of America Global Research, told CNN, “the eurozone seems closer to a stagflation scenario” — the dreaded combination of high inflation and little, if any, economic growth.

Europe’s official statistics agency Thursday revised down its estimate of GDP growth for the 20 countries sharing the euro from 0.3% to 0.1% for the second quarter of this year.

Industrial production in Germany fell for the third-straight month in July, official data also showed Thursday, adding to a cocktail of woes for Europe’s largest economy.

A weaker euro will likely push up the price of imports, in turn, fueling inflation. Adding to the upward pressure are crude oil prices, which have climbed in recent weeks as Saudi Arabia and Russia have extended supply curbs.

China’s economy is also facing a wave of huge challenges: Consumer prices are falling, a real estate crisis is deepening and exports are in a slump.

The People’s Bank of China has cut key interest rates on mortgages and on its lending to banks in recent months to help boost demand for credit.

“China’s weakness not only has weighed on the [yuan], but other key currencies in the region, as well as those major trading partners, including the euro,” Alex Cohen, senior FX strategist at Bank of America Global Research, told CNN.

Source : CNN