U.S. stock investors are turning their focus to next week’s inflation data, which could determine the near-term path of an equity rally that has wobbled in recent weeks.

Signs the U.S. economy is on track for a so-called soft landing, where the Federal Reserve is able to bring down inflation without badly damaging growth, have helped power the S&P 500’s (.SPX) 16% year-to-date gain.

Last week’s employment data played into that narrative, showing the job market remained robust, though not strong enough to spark worries that the Fed would need to hike interest rates more to fight inflation, moves that rocked markets last year.

Consumer price data next week may need to strike a similar balance, investors said. Too high a number could fan fears of the Fed leaving interest rates higher for longer or hiking them more in coming months. That would give investors less reason to hold onto stocks after a tech-led drop in which the S&P 500 lost about 5% from summer highs.

“This inflation demon is far from being destroyed,” said Michael Purves, head of Tallbacken Capital Advisors, who expects signs of higher inflation will weigh on the multiples of megacap growth names that have powered the rally. “If we’re hitting a structural shift with higher nominal GDP growth, that will come with some volatility and unintended consequences.”

Investors trying to assess future Fed policy will watch other data in the coming week too, including a reading of the producer price index and retail sales.

The U.S. central bank is widely expected to hold benchmark rates steady at its Sept. 20 meeting. Markets are also pricing in a nearly 44% chance of a rate hike at the Fed’s Nov. meeting, up from 28% a month ago.

“If we get a high inflation print we will see those expectations pick right up” for September and November, said Randy Frederick, managing director of trading and derivatives for the Schwab Center for Financial Research.

OPTIMISTIC, BUT CAUTIOUS

Strategists and investors currently have largely held faith in the market despite stocks’ recent wobble. Some, though, are growing more cautious.

Reasons for optimism include the relative outperformance of the U.S. economy compared to Europe and China, and signs the so-called profit recession among S&P 500 companies may be over.

Still, worries over an economic slowdown in China and concerns that U.S. corporate margins will shrink have led some market participants to believe squeezing more gains out of stocks will grow more difficult.

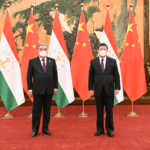

The S&P 500 Information Technology sector lost more than 2% this week following news that Beijing had ordered central government employees to stop using iPhones for work.

Source : Reuters